Planned-Giving

What is Planned Giving?

Planned giving is the act of making a commitment to Chicago Theological Seminary as part of your legacy. It is an expression of your lifelong values and dedication to the mission and vision of the seminary. And, it says that, after your family and loved ones, CTS matters to you.

By designating a gift for CTS, you will join the Victor and Jessie Lawson Society, an honored group of others who have also committed to CTS’s future through planned giving

Let’s Talk

Planning your estate and legacy for future generations including your charitable interests takes careful evaluation.

Discussing your charitable intentions with us can lead to a much better result than going it alone – and will ensure that your gift is used just as you wish. Act now to be a good steward of the resources you intend to leave behind. Contact Chad Schwickerath directly or submit this form below to get more information.

How Does It Work?

Many individuals and families support CTS by making of a planned gift. Some gifts are made in a will or trust. Others provide lifelong income to a donor. Planned gifts might include retirement assets, life insurance, real estate, or personal property. Even gifts of cash and stock may be considered to be planned gifts. In fact, any time you stop to consider the timing or tax benefits of making a gift, you may be making a planned gift.

This site is designed to provide the information you need when considering such a donation. You will also find information to share with your financial advisor and/or estate planner. When you are ready, you can use this site to reach out to us to share your plans, let us know your questions, or just start a confidential conversation about what’s possible.

Why Give?

A gift from your estate and heirs sustains our mission of preparing the next generation of religious leadership. But it is more than that.

A planned gift to the seminary is a statement of your lifelong values and eternal commitment to the mission and vision of CTS. It says the future of CTS is important to you. And it provides a wonderful, impactful way to be remembered.

Where to Give?

If you choose, your gift can be designated for a specific area that matters most to you. Consider directing your planned gift to these core missions and ministries or directing your planned gift as an unrestricted gift to CTS.

How to Give?

As a donor, you have total discretion over your planned gift. You have options for how your planned gift will be used, what to give and how to give. There are planned gifts you can provide for in a Will or trust and planned gifts that provide income to you and/or a beneficiary for their lifetime.

-

Gifts from your Will

BequestsThrough a provision in your written and executed will or living trust, you can make a planned gift (or an outright gift as well) to CTS in the form of cash, securities, real estate or personal property. There are many types of bequests. Consult with your attorney to choose the one that best fits your needs and intentions.

-

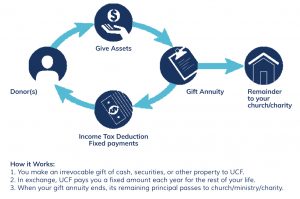

Gifts that Pay You

Charitable Gift AnnuitiesYou can turn underperforming or non-income producing assets (cash, stock, CDs, savings bonds, etc.) into a gift to CTS that provides income to you or you and a loved one. (One example of several available options is a Gift Annuity.) Your UCF Charitable Gift Annuity will return fixed, quarterly payments for life and provide tax benefits, too.

-

Beneficiary Gifts

Retirement Accounts and other FundsNaming CTS as the beneficiary or one of the beneficiaries of a qualified retirement plan asset such as an IRA, 401(k), or 403(b) will accomplish a charitable goal while realizing significant tax savings.

-

Gifts of Appreciated Assets

Buy Low. Give High.When you donate appreciated stocks, bonds, or mutual fund shares instead of cash, the benefit the church receives exceeds the cost of the original securities purchased. You’ll receive a charitable deduction for the full amount of your gift and avoid the impact of the capital gains taxes on the appreciated securities.

-

Outright Gifts of Personal Property

Real Estate and Other ValuablesPersonal property, such as antiques, collectibles, musical instruments, works of art or vehicles, can be donated to us today or even after your lifetime through your estate. If the property is related to our mission, it’s usually fully tax-deductible based on its fair market value. In some cases, your gift of personal property can be used to fund a life-income gift, such as a charitable gift annuity or charitable remainder trust.

-

Gifts of Life Insurance

Name CTS as the beneficiary of an existing life insurance policy; donate an existing, paid-up life insurance policy you no longer need; or purchase a new life insurance policy and name CTS as the owner and beneficiary.

For Professional Advisors

If you are working with a professional advisor or if you are advising a donor, here’s a handy guide for including CTS in a charitable estate plan.